Member Login

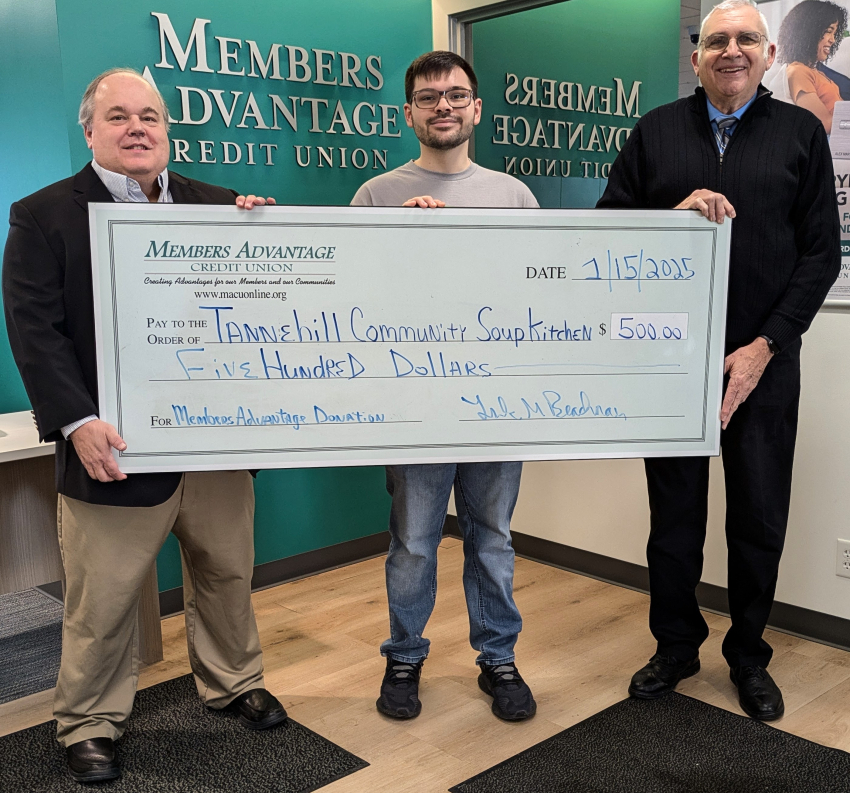

MACU Donates to Michigan City Soup Kitchen

Today, MACU was honored to present the Tannehill Community Soup Kitchen with a donation. An appreciative Tannehill representative said, "Our mission wouldn't be possible without the support of our community." Thank you for the good work you're doing in Michigan City!

Members Advantage Credit Union Offers College Scholarships

Members Advantage Credit Union (MACU) is excited to announce the acceptance of applications for its annual Leona Bruno and Gail Walker scholarships. These scholarships are open to high school seniors and students in their first or second year of college, providing financial support to help them achieve their educational aspirations.

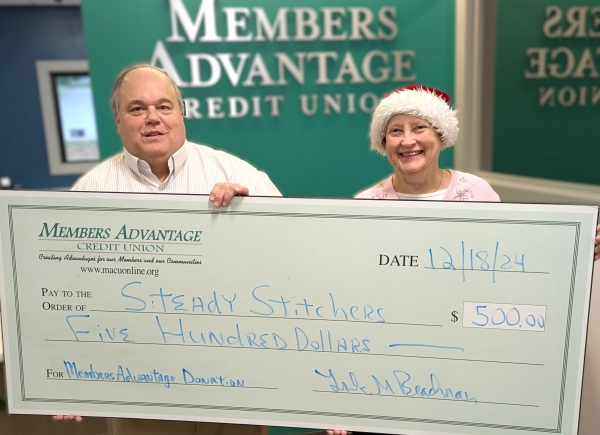

MACU Donates to Steady Stitchers

Giving back to our community is at the heart of what we do! Members Advantage Credit Union is proud to support the amazing work of the Steady Stitchers with a $500 donation. This incredible local non-profit has been transforming fabric and generosity into handmade items for residents in need. Their dedicated volunteers use their sewing skills to bring comfort and hope to those facing tough times.

We’re honored to help support their mission and make a difference right here in our community.

Pictured: MACU President Frank Beachnau Presents a Check to Janet Gourley of Steady Stitchers

MACU Donates to Salvation Army

Yesterday, the Michigan City Salvation Army held its annual Red Kettle Kickoff for the bell-ringing season at McDonald's in Michigan City. MACU is honored to support this wonderful cause with a $1,500 donation. We love being part of such a caring community and are proud to support the Salvation Army’s efforts to bring joy and assistance to those in need this holiday season. ❤️

Pictured is MACU's Shannon Gillem (middle) with Salvation Army's Major Dale Simmons (left) & Major Becky Simmons (right).

Community-Wide Shred Day: June 28, 2025

MACU’s Shred Day is on the books for Saturday, June 28. Shredding sensitive documents helps prevent identity theft. Do your part to protect your identity by bringing your documents to the Ohio Street branch to be professionally disposed of.

Pull up to the shred truck, and MACU team members will be available to take your documents to the shredder. Shred Day is open to the community.

We partnered with Salvation Army, and they will be collecting nonperishable goods for our community.

Frequently Asked Questions Regarding Your New Visa Card

Notification of payees:

Should I notify companies that I am set up to pay automatically with my existing VISA and have a new card number?

YES. You will need to notify companies that you are currently paying automatically with your VISA and that you have a new card number so that they can update their records.

How to make a Payment:

Will I still be able to make my VISA payment at the branch?

Here are two payment options for making a payment on your new VISA Card:

1. You will be able to send your payment to the address below:

Cardmember Service

PO Box 790408

St. Louis, MO 63179-0408

2. Go to the MACU website (https://www.macuonline.org/products-services/creditcards/card-payments), go under Products and Services, then Credit Cards, and make a credit card payment. You can make payments once you add the routing number and account number you wish the Visa payment to come from.

Card Usage:

How soon can I start using my new card that was recently mailed to me?

Once you activate your new card, you may use it immediately. Please destroy your old card once you have registered your new Visa Card. Your old card will no longer work as of 2/22/24.

I never received my new Visa Card:

What should I do if I still need to receive my new Visa Card?

Call Cardmember Service 24/7 at 1-800-558-3424 and request a replacement card.

Apply Now To Be A Volunteer On MACU's Supervisory Committee

If you have ever wanted to learn more about the operations of a credit union, consider volunteering as a Supervisory Committee member. The primary role of the Supervisory Committee is to coordinate the hiring of the external auditing company and report the findings of the audit. Additional responsibilities of the Supervisory Committee are to meet at least quarterly to discuss the committee’s audit findings of special audit projects that have been performed by committee members. Time requirements are only approximately 2-3 hours a month. The Supervisory Committee is always looking for volunteers who are passionate about the success of their credit union. The Supervisory Committee is accepting applications for this volunteer position.

If you have additional questions about becoming a Supervisory Committee volunteer, please contact us at (219) 874-6943 or email the credit union at This email address is being protected from spambots. You need JavaScript enabled to view it..

Protect Yourself From Fraud

Scammers are always changing their methods to gain unauthorized access to your personal data. Safeguarding yourself by becoming acquainted with these vital guidelines and reminding watchful for any unusual account activities.

Fraud Tips:

- Do not share your one-time passcodes, PINs, passwords, or debit and credit card numbers.

- Review your monthly statements for anything that isn't normal.

- MACU will NEVER contact you to ask for your personal information by email, text, or an unsolicited call.

- Do not open any emails from people you do not know or click on the link within the message.

- Use account alerts to stay on top of your account activity.

- Use caution with pop-up windows. If prompted, do not enter personal information or call an unverified number.

- Consider signing up for IDProtect through MACU.

For additional tips and resources on protecting you and your family from identity theft and fraud, visit our partner, GreenPath, or call us for more information.

Please contact us immediately at 219-874-6943 if you think or know you've been a victim of fraud.

Identity Theft & Fraud: How to Protect Yourself

In today's hyper-connected world, safeguarding your online identity is paramount. Join us for an insightful recorded webinar hosted by GreenPath Financial Wellness. They will delve into the essentials of identity theft and online fraud, illuminate common scams to watch out for, and equip you with strategies to fortify your digital defenses.